snohomish property tax payment

Taxes can be paid by eCheck debit or credit card using our Interactive Voice Response IVR system. Click for Instructions.

Snohomish County Treasurer Payments

If you pay the first half of your taxes by April 30th but fail to pay the second half by October 31st the unpaid portion is subject to 1.

. To pay by phone youll need to call the Snohomish County Treasurers Office at 425. Schedule a Free Consultation Today. The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information.

Interest continues to accrue until the taxes are paid in full. Contact Us To Learn More. Ad Achieve Property Tax Compliance Avoid Penalties.

The median annual property tax payment in the county is just 1768. Please have your bill and bank or credit card information ready when you call. Ad Get In-Depth Property Tax Data In Minutes.

Choose Avalara sales tax rate tables by state or look up individual rates by address. Snohomish Countys average tax rate is 089 of assessed home values which is well below the national average of 11 and slightly below the Washington statewide average. 2022 Point Pay.

Providing an Unrivaled Customer Experience for Over 20 Years. This means that the average homeowner in. Such As Deeds Liens Property Tax More.

Schedule a Free Consultation Today. The average effective property tax rate in Snohomish County is 119 which is nearly double the state average of 064. Contact Us To Learn More.

Providing an Unrivaled Customer Experience for Over 20 Years. Heres what you need to know about paying your Snohomish County property taxes by phone. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

A fee set by the vendor is charged for. Call us toll-free 24-hours a day to make a fast and easy payment. The Assessor and the Treasurer use the same software to record the value and.

Start Your Homeowner Search Today. Search Valuable Data On A Property. For a copy of the original Secured Property Tax Bill please email us at infottclacountygov be sure to list your AIN and use the phrase Duplicate Bill in the subject line or call us at.

Ad Achieve Property Tax Compliance Avoid Penalties. Whatcom County sits in the northeast corner of Washington State along the Canadian Border.

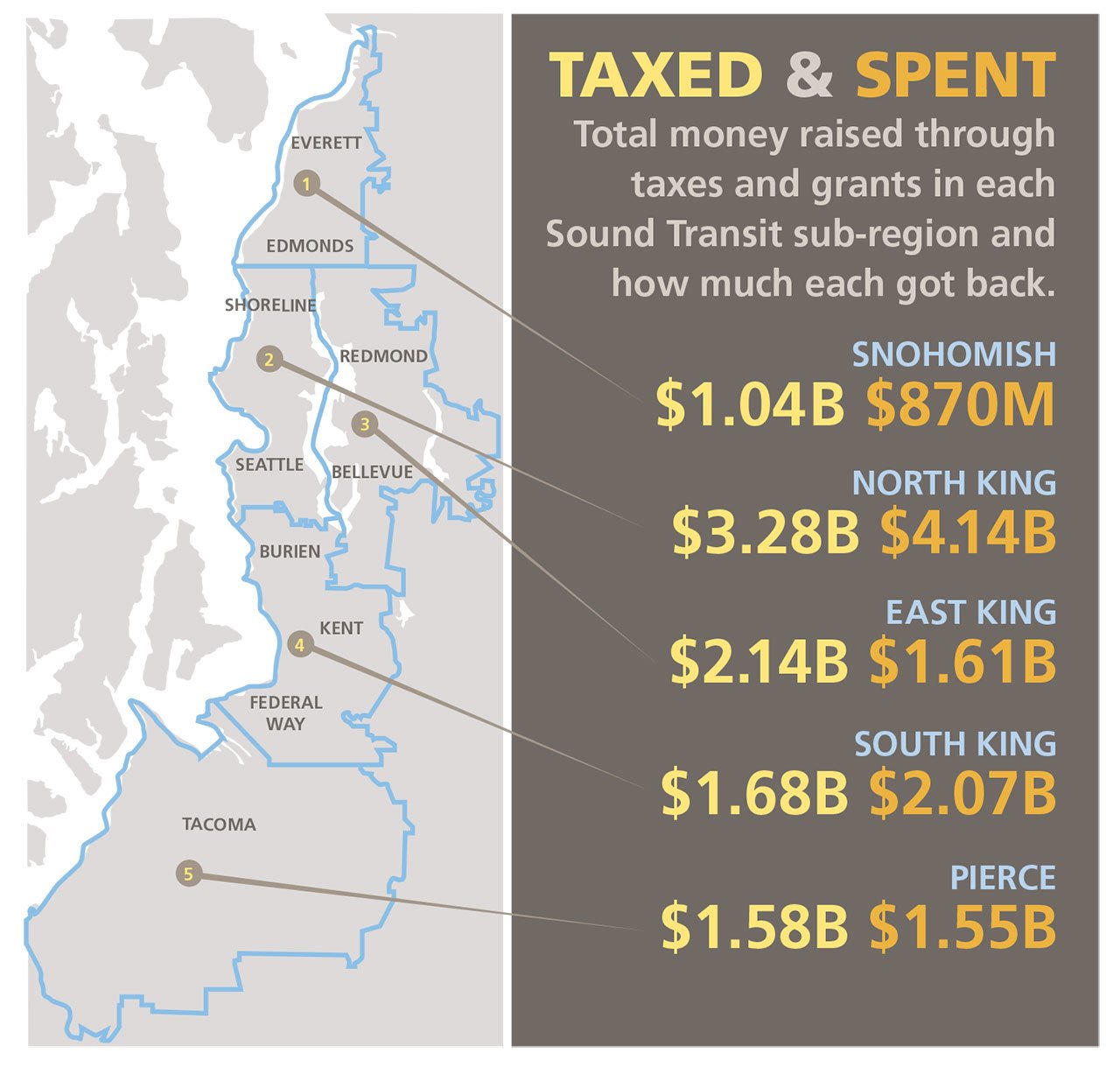

Tax Trouble Sound Transit S Tax District Splits Some Properties King5 Com

Snohomish County News Events And Activities

Snohomish Wa Land For Sale Real Estate Realtor Com

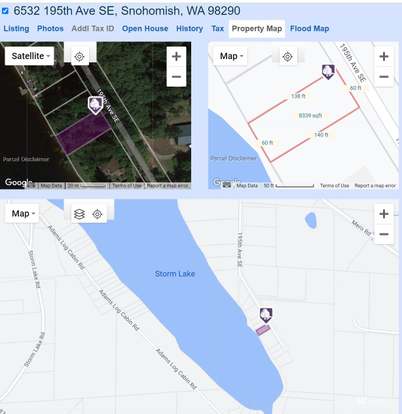

6532 195th Ave Se Snohomish Wa 98290 Mls 1976621 Redfin

News Flash Snohomish County Wa Civicengage

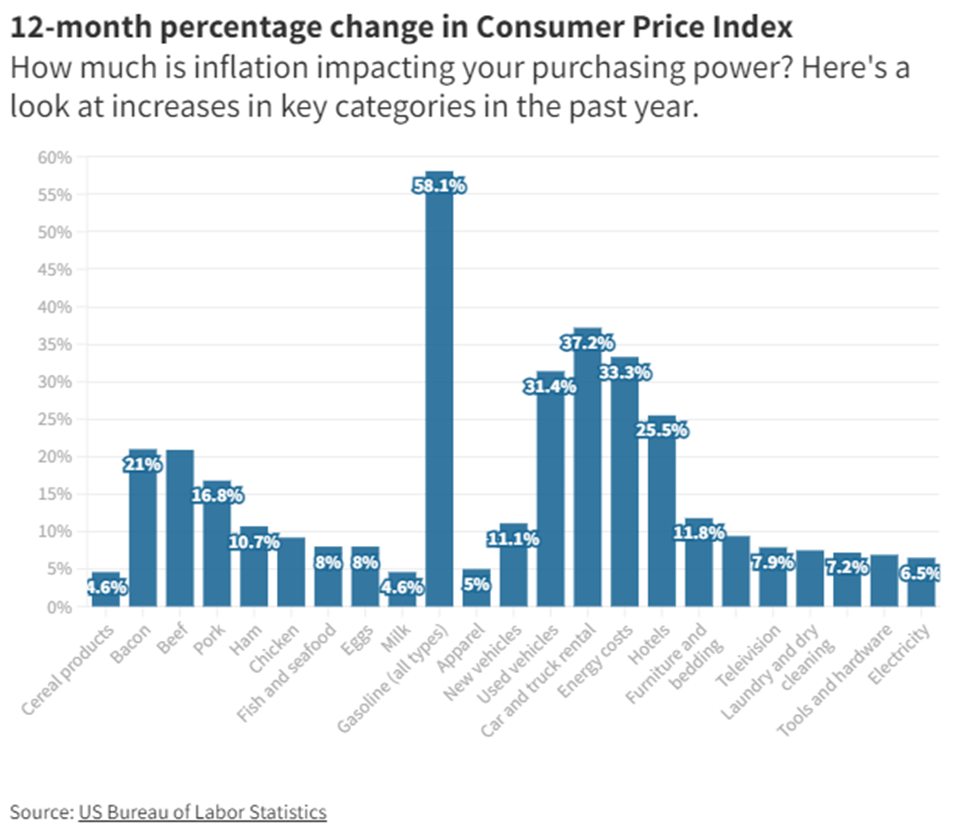

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

16315 State Route 9 Se Snohomish Wa 98296 Loopnet

How To Read Your Property Tax Statement Snohomish County Wa Official Website

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

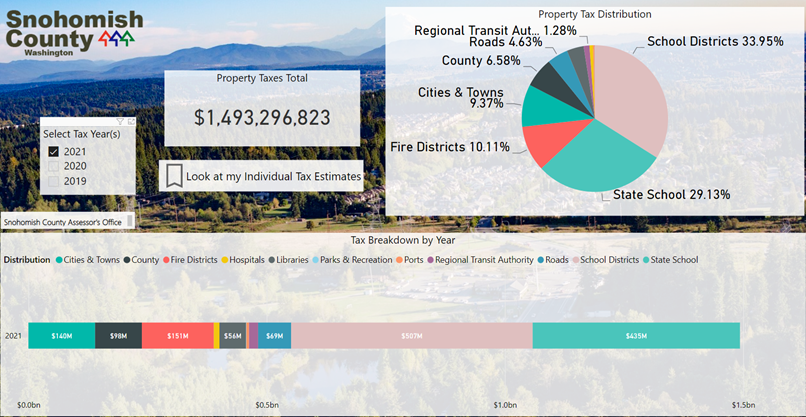

Property Taxes And Assessments Snohomish County Wa Official Website

Tax Payment Options Snohomish County Wa Official Website

About Our District 2022 Snohomish School District Proposed Replacement Levies

Graduated Real Estate Tax Reet For Snohomish County

What Snohomish County Would Pay And What St3 Would Deliver Heraldnet Com

Taxes Incentives Doing Business In Stanwood Wa

Snohomish Washington Wa 98290 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Hecht Group Paying Your Snohomish County Property Taxes By Phone