tax fraud lawyer salary

Entry-Level Attorney Opportunities Salaries Benefits and Promotions. Get a salary report by industry company size and skills.

Tax Help In Mineola Ny Tax Help Tax Attorney Tax Lawyer

The Tax Attorney I role earned an average salary of 101824 in Texas in 2022.

. Penalties for tax fraud and evasion can. The Tax Attorney I role earned an average salary of 98725 in Florida in 2022. A tax fraud attorney represents clients who the government claims have manipulated the system by paying too little tax or no tax at all.

To arrange a free consultation with a. A 100 confidential service. The United States Bureau of.

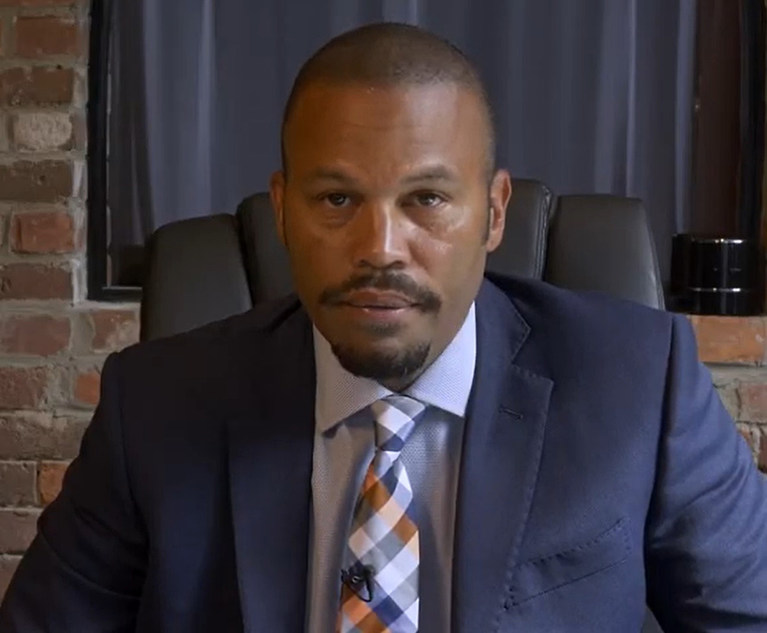

He has tried cases involving charges of bank fraud money laundering wire and mail fraud RICO and tax fraud. That could mean tax lawyers will have to keep track of every minute of work they do for clients. Freeman was released on 100000 bond and is required to report to prison on.

Choose from lawyers in your area. There is a variation in the salaries of a corporate tax lawyer as salaries in. Find a Fraud Lawyer Now Find a category or issue not listed.

No fee to present your case. How much does a TAX Lawyer make. Idaho average lawyer salary.

Just in case you need a simple salary calculator. According to BLS the average income of a corporate tax lawyer is 120910 per year. Skip to Job Postings Search.

Apply to Associate Attorney Staff Attorney Counsel and more. Hartford Lawyer Convicted of Tax Fraud Ordered to Begin 2-Year Prison Sentence in September. By litigating these cases our lawyers play an essential role in developing federal tax law and in.

If you or your business is facing IRS fraud charges you need to make sure your case is handled properly by a seasoned federal criminal defense attorney. Tim has represented a wide variety of public and private figures over the years. Get a salary report by industry company size and skills.

As of Aug 13 2022 the average annual pay for a TAX Lawyer in the United States is 99922 a year. Penalties for tax fraud and evasion can. The salary of most tax lawyers is often determined by billable hours.

Legality Of Refusing To Pay Income Tax Legalmatch

Bitcoin Tax Attorney Experienced Us And International Tax Lawyer Cpa

California Payroll Tax Lawyer Edd Employment Development Department

Nysdtf Infographic National Tax Security Awareness Week Tax Help Infographic Awareness

Hartford Lawyer Convicted Of Felony Tax Fraud After Spending Lavishly On Himself Connecticut Law Tribune

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Bitcoin Tax Attorney Experienced Us And International Tax Lawyer Cpa

Securities Lawyer Salary Comparably

Comparative Analysis Between Rera Consumer Protection Act Consumer Protection Legal Advisor Corporate Law

Legal Notice Format Procedure In India Secretarial Services Legal Legal Services

How Much Does A Tax Attorney Cost Cross Law Group

Is Tax Fraud A Felony Klasing Associates

Why Is Professional Tax Deducted From Your Salary Legal Services Being A Landlord Private Limited Company

Why Tax Lawyers Are The Richest Lawyers

2022 Attorney Fees Average Hourly Rates Standard Costs

Cpa Vs Tax Attorney Top 10 Differences With Infographics

What Type Of Lawyer Makes The Most Money The Highest Paid Lawyers